- Home

- Overspending Grant Budget

WHAT TO DO WHEN YOU

OVERSPEND A GRANT BUDGET

When an organization receives a grant from a donor, the grant will typically include an approved budget. In most cases, the budget will likely be the maximum amount that can be spent on the grant and thus paid for using the grantor’s funds; however, there may be other “loss-producing” restrictions that the organization needs to consider. In addition, the organization will need to formulate a plan should it expend more funds than allowed under the grant.

Most often, is it difficult for an organization to spend the exact amount of a grant. Sometimes, the organization may slightly underspend the full amount allotted in the grant agreement. In those situations, the organization will typically have to return any unspent funds if funding was advanced to the organization, or, if the grant is cost-reimbursable, the organization will just not be able to bill the donor up to the full amount of the agreement.

In some instances, however, the organization may overspend the grant amount. When this happens, the organization has two primary options available to cover those costs that exceeded the amount allotted.

- The organization can request additional funding from the donor; or

- The organization can obtain funding from other sources to cover the amount spent in excess of the grant threshold (including using the organization’s unrestricted funds).

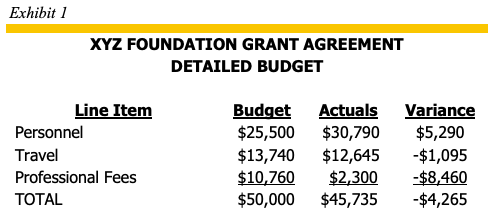

In addition to the possibility of overspending the entire grant amount, there may be additional restrictions that may cause the organization to be “out-of-pocket”. For example, the grant agreement may stipulate that individual budget line items also contain overspending restrictions. As shown in Exhibit 1, an organization has a grant with XYZ Foundation for $50,000. Clearly, the organization underspent the overall grant amount by $4,265 in which case the organization may consider this a success as they did not exceed the maximum amount available under the grant. However, upon further reading of the grant terms and conditions, the organization is required to spend no more than 10% above the amount per line item up to a cumulative spending of $50,000. In this case, the maximum amount available for the organization to spend on “Personnel” costs is $28,050 ($25,500 x 1.10%). Since the organization spent $30,790 on this line item, the difference between the maximum amount allowed ($28,050) and the actual amount spent ($30,790) means the organization will not be allowed to claim $2,740.

In addition to line-item restrictions, there may be other stipulations in the grant agreement that require the organization to request prior-approval from the grantor. This may include the ability to reallocate costs from one budget line-item to another, matching requirements, or limits on an organization’s general and administrative (or overhead/indirect costs).

Given the various stipulations that may exist in a grant, it’s important for organizations to thoroughly review all grant agreements before contractually agreeing to them. These restrictions may appear insignificant at first, but they may have significant financial impact on the organization should it not be able to recover all of the costs incurred.