- Home

- Capital & Operating Leases

KEY DIFFERENCES BETWEEN

CAPITAL & OPERATING LEASES

Aside from purchases assets, many nonprofits will opt to lease assets instead. Some of the reasons for this is because purchasing an asset outright will require the nonprofit to have enough cash to make the purchase which means there would be less cash available for other needs, the nonprofit may only need the asset for a given time-period in which case purchasing the asset and then trying to sell the asset would be an added burden, and the type of asset needed may be subject to a short lifespan (such as technology) which renders purchasing it unnecessary. Examples of assets that can be purchased or leased include vehicles, furniture and equipment, and office space.

The two most common types of leases are capital and operating leases. The conceptual difference between these two types of leases is 1) with a capital lease you are in effect purchasing a capital asset and 2) with an operating lease you are paying a fee for the temporary use of an asset.

A lease should be classified as a capital lease if any one of the following conditions is met:

- Ownership of the asset automatically transfers from the lessor to the lessee at the end of the lease term;

- The lease contains a bargain purchase option;

- The term of the lease is for 75% or more of the estimated economic useful life of the asset; or

- The present value of the minimum lease payments is 90% or more of the fair value of the asset. To calculate the present value of the minimum lease payments, the lessee should use its own incremental borrowing rate unless (a) the lessee is able to determine the implicit rate and (b) the implicit rate is lower than the incremental rate.

Should none of the four conditions above be met, the lease is considered an operating lease.

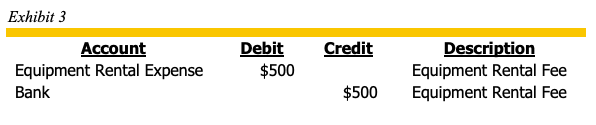

As shown in Exhibit 1, when a nonprofit has a capital lease, the initial entry in the accounting system will be to debit the fixed asset account and credit the capital lease liability account for the fair value of the asset. At this point, only the Statement of Financial Position is affected by the entry.

Thereafter, each month the nonprofit would record the lease payments as shown in Exhibit 2. A corresponding amortization schedule should be maintained by the nonprofit to support each entry and to ensure the financial statements are accurate. Such schedule is available for download on ANAFP’s website.

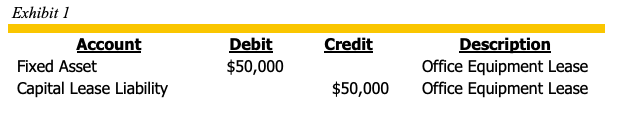

On the other hand, should the nonprofit have an operating lease, no initial entry, such as the one made in Exhibit 1, is recorded in the accounting system. Instead, the organization will simply record the monthly lease payment amount as an expense as shown in Exhibit 3.